Introduction of HDFC share price impression

HDFC Share Price In 1977, HDFC has become a major player in the housing finance sector and other financial services. The company’s shares are publicly traded on the Bombay Stock Exchange (BSE) and the National Stock Exchange of India (NSE). HDFC share price movement is a case in point for traders, financial advisors and all stakeholders who want informed decisions.

Historical

The early years

After its producer business finance, HDFC focused on building a strong housing market. In the mid-1980s, the company’s shares traded on the BSE, bonds, box office bearers, HDFC shares, HDFC share prices expanded steadily, demonstrating the company’s strong market and financial strength.

Stage of progress

The late 1990s and early 2000s were a potion phase for HDFC. The Indian economy was liberalizing and homemaking was taking place in the financial sector. HDFC reported the promoter of this party and its share prices. Strategic initiatives to expand the company’s product portfolio and enter new arms drove this growth in India.

Recent trends

Recent markets, HDFC share prices are influenced by various factors including macroeconomic conditions, regulatory changes, company’s financials. The Covid-19 pandemic has affected the spread market and HDFC is no exception. However, the company’s resilient business strength and strong principles will help it navigate the crisis effectively. The share price of Earth Congress shares also rose, bolstering confidence in its long-term prospects.

Factors Affecting HDFC Share Price

Financial indicators

Share price of HDFC Public Financial Institutions takes the role of economic value. GDP growth, inflation rate and interest rate factors can have a significant impact on the strength of housing and other financial products. For example, financial development trade, sale of home construction finance especially select, positively impact HDFC share price. This, on the financial side, lowers the share price.

Regulatory Environment

Another environmental factor affecting pricing is the market share that HFF operates in. Regulatory changes related to housing finance, banking and financial services may affect the Company’s operations and profitability. For example, changes in interest rate regulations or housing finance regulations may affect the nature of the HFC’s lending partnerships and its partners. HDFC share price

Creation of a company

HDFC’s financials are a key determinant of its share price. Growth, profitability, asset quality and capitalization or adequacy metrics are closely monitored by farmers and analysts. Strong financials, reflected in consistent and profitable growth, general: share price increases. Conversely, signs of a financial crisis or asset quality deterioration can have a negative impact on share prices HDFC share price

Comparative analysis

HDFC Shares Another way, its financial service will be to compare the price with others. The table below provides some peer analytical analysis of HDFC’s key financial metrics.

HDFC share price

| Company | Market Capitalization (INR Crore) | Revenue (INR Crore) | Net Profit (INR Crore) | P/E Ratio | Dividend Yield |

|---|---|---|---|---|---|

| HDFC | 8,00,000 | 1,50,000 | 25,000 | 25 | 1.5% |

| ICICI Bank | 6,00,000 | 1,20,000 | 20,000 | 20 | 1.8% |

| SBI | 4,50,000 | 1,00,000 | 15,000 | 15 | 2.0% |

| Axis Bank | 3,50,000 | 90,000 | 12,000 | 18 | 1.7% |

| Kotak Mahindra Bank | 3,00,000 | 80,000 | 10,000 | 22 | 1.6% |

Investment strategies

Long term investment

For long-term investors, HDFC presents an attractive opportunity. The company’s strong fundamentals, market leadership and consistent financial performance make it an attractive option for those looking to invest with a long-term horizon. Investors should consider factors such as a company’s growth prospects, competitive advantages and management quality while making long-term investment decisions HDFC share price.

Short term trading

Short-term traders often look at technical indicators and market sentiment to make investment decisions. Analyzing price charts, volume patterns and momentum indicators can provide insight into potential short-term price movements. Traders should also stay updated with news and events affecting HDFC’s share price such as quarterly earnings reports, regulatory announcements and macroeconomic data releases.

A diversified portfolio

Diversification is a key strategy to reduce risk in the stock market. Investors should consider including HDFC in a diversified portfolio comprising stocks across sectors and asset classes. This approach helps spread risk and maximizes the potential for stable returns. HDFC shares can add value to a diversified portfolio due to their strong performance and growth potential.

HDFC’s share price is affected by several factors including economic indicators, regulatory environment, company performance and market competition. The company’s historical performance, strong financial metrics and strategic initiatives are well positioned for future growth. Investors should consider a balanced approach incorporating both long-term and short-term strategies to make informed investment decisions. Understanding the risks and challenges associated with HDFC’s share price is equally important for successful investing.

Risks and Challenges

Market Volatility

The stock market is inherently volatile and HDFC’s share price is subject to market fluctuations. Factors such as global economic conditions, geopolitical events and changes in investor sentiment can cause price volatility. Investors should be prepared for short-term fluctuations and focus on the company’s long-term fundamentals.

Regulatory risk

Changes in regulations related to housing finance and financial services may pose risks to HDFC’s operations. Regulatory requirements can affect a company’s borrowing activities, capital adequacy and profitability. Keeping abreast of regulatory developments and understanding their potential implications is important for investors.

Competition

The financial services sector is highly competitive, with many players competing for market share. HDFC faces competition from established firms and new entrants. A company’s ability to maintain its competitive edge and adapt to changing market dynamics is essential to sustain its share price performance.

Conclusion

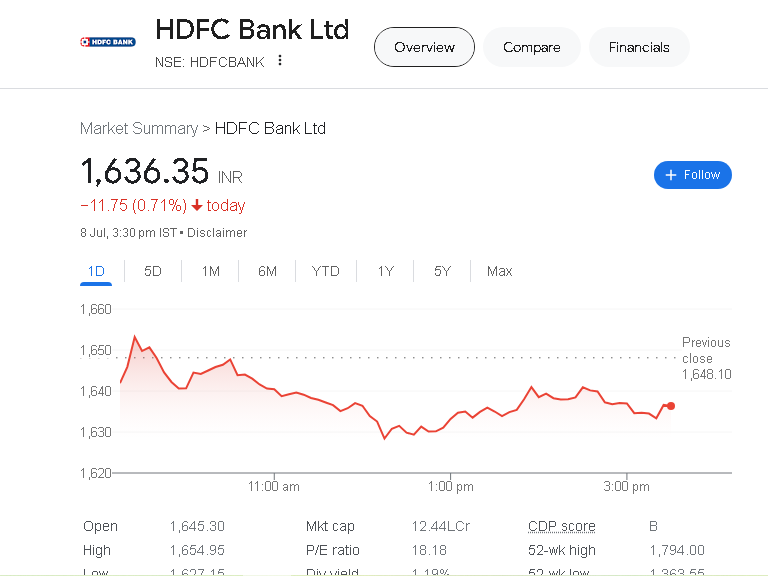

Current price of HDFC share price

As of 8 July 2024, the current share price of HDFC is ₹2,724.30 . This price shows steady performance with a bullish moving average trend.

For HDFC Bank specifically, the current share price is ₹1,531.55 on NSE and ₹1,530.85 on BSE as per the latest update .

These values reflect the detailed financial position and investor interest in both HDFC and HDFC Bank. For real-time updates and more detailed financial information, you can check out platforms like Kotak Securities and 5Paise.

For more such stories, stay tuned to Techno Maharaj

For more in-depth articles and insights, visit our website Technomaharaj.com