Money Management and Emotionless Trading are key to long-term success in the financial markets.

Money Management and Emotionless Trading.

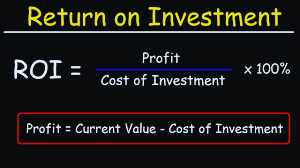

Return of Investment per Annum

- A = <10%

- B = 10% to 20%

- C = 20% to 30%

- D = > 30%

Your Expectation on Investment of 1Lakh.

Money Management and Emotionless Trading.

Rules and Regulation

- In share market we should not expect any % of return.

- It can cause overtrading that should be our mindset.

- I will not expect any fixed return from stockmarket

- whatever we get from stock market we should keep afely

- Always remember Follow the Process not Profit.

Money Management and Emotionless Trading.

Some Strict rules to remember before you start trading.

- Buy with your own money.

- No exposure/ Borrowing.

- Completely Avoid buying a stock which is at low price.

- Don’t prefer high value stocks.

- Prefer the stock everyone can trade.

- And the list goes on!

The Stock less than 50 rs is Called Penny Stock.

In penny stock 100% we should avoid trading. Because of their low prices, penny stocks can be extremely volatile and risky investments.

- Movementum is very slow.

- Volume is low.

- If we get trap our capital will get in trap and we will be in problem.

- The money which we invest is known as Capital

- Money Management and Emotionless Trading.

The Stock between 300-3000 rs is Called Idol Stock.

- 300 to 3000 rs stock we should trade. in that movementum is also fast and volume is also high.

- 300 to 3000 rs stock is also called idol stock.

- We get 1000 of opportunity in stock market in our daily life.

- If we get trap in FOMO we will get draft out.

- FOMO- Fear Of Missing Out

- Don’t trade by seeing on television we should avoid that news based trade volume for very low time.

- By analysis our trade we get good capital, volume, in our stock.

- Above 5000, 10000, 20000 we should not trade high paying stock has volatility is in extreme level.

- Stoploss can easily hit.

- Risk Reward.

- Money Management and Emotionless Trading.

There are several types of trading. with its own strategies and timeframes:

- Intraday

- Cash

- Future

- Option

- BTST/STBT Future

- BTST- Buy Today Sell Tommorow.

- STBT-Sell Today Buy Tommorow.

- Possible with few brokers and in listed stocks.

- Swing – 3 to 5 Days Holding.

- Cash

- Future

- Option are Best

- Short Term Positional – 2 to 4 weeks cash preffered.

- Long Term Delivery 1 Year.

- Long Term Delivery means less than 1 year we board any stock is called Long Term Delivery.

- Scalping – Means trade for few min/sec.

- Swing Trading is also known as mother of all Trading.

- In swing trading their is low risk.

- Swing trading is very powerful trading.

Trading Discipline.

- Do not do more than 2 trades in a day.

- Don’t chase rates.

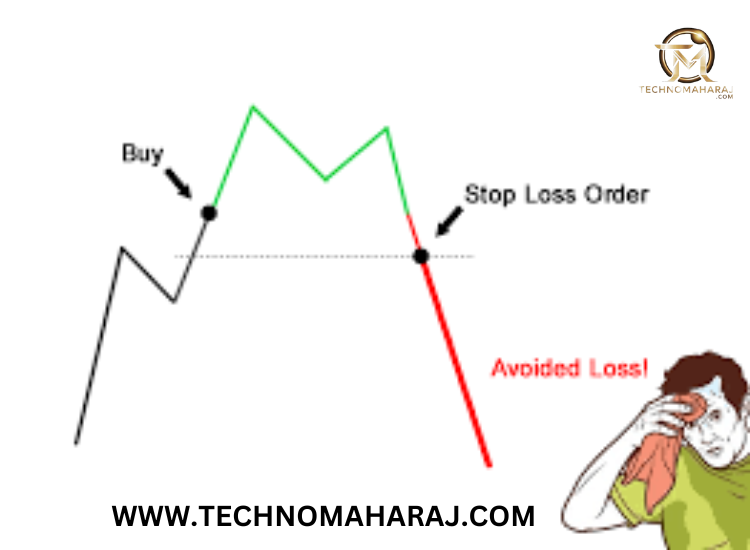

- Don’t hesitate to book loss at stoploss stages.

- Wait for trend or signal then enter in trading.

- Don’t go against the market.

- Don’t take position for full margin.

- Buy option only 10% of your capital.

- Last – Don’t panic.

- We should accept both loses and profit stock market.

- Lose should be minimum profit should be maximum.

- Levels always matter in stock market.

- We cann’t find any top or bottom of a stock.

- Stock market plays on power of compounding.

- These is called Money Management and Emotionless Trading.

Money Management.

Money management is important for successful investment in the stock market

- Delivery Trading – Split your capital in 10 parts and invest 1 part in each stock. Any capital is sufficient to start with.

- Index Future – Capital of 1.5 lakh trade only in one slot.

- Stock Future Positional – Capital of 3 lakh required for 1 lot intraday trading.

- Stock Future Intraday – 1 lakh required for 1 lot intraday trading.

- Index Option – Per lot premium should be not exceed 5k. Capital of 20k capital requiredfor sustainable trade.

- Stock Option – Per lot permium shouldn’t exceed 10k-15k. Capital of 30k required for sustainable trade.

If we have 1lac div them into 10 parts means each part cost 10k. Now, don’t invest it in same sector. 10k-15k trade is enough in a month.

Money Management and Emotionless Trading.

StopLoss are of Three Types.

- DSL – Default stoploss.

- 5% loss we should use Default stoploss and exit.

- TSL – Technical stoploss.

- Maximum 2.5%, Not than high.

- T TSL – Trading stoploss.

- Means shift automatically /we can do manually too. eg; 100, stock refer stoploss of 98 .

Use Parellel Pyramiding Method.

- Senerio1 – After i close my trade stock goes in a profit.

- Senerio 2 – After hitting SL its getting in a profit.

- Points to Remember-

- Wrong Trade.

- Wrong SL of place.

- Wrong Instruments.

- Wrong Time.

- Points to Remember-

- Money Management and Emotionless Trading.

Solutions.

- Analysis.

- Select the script.

- Wait for level.

- Wait for entry signal.

- Make on entry.

- Place of SL.

- Book Profit/Loss.

SIP – Systematic Investment Planning. A mutual fund is a method of investing a certain amount of money on a regular basis. Instead of investing a large amount at once, you can invest smaller amounts monthly, quarterly or at any regular interval. It helps build wealth over time and reduces the risk of market volatility. SIP is easy to start, flexible and suitable for long-term financial goals.

- Don’t get trape in Donkey work.

- Get trapr in smart work.

- Only trade in stock equity cash market.

- Only deliver trading.

- Holding period 5-15 day per trade.

- Strict SL of 5% per entry.

- Trading should done only by you.

- Money Management.

- Target of 5%.

- Money Management and Emotionless Trading.

Day-1 What Is Meant by Share? Important Introduction part- click here